November 02, 2022

But beware, not all private debt is created equally.

The current geopolitical climate, the pressure on global supply chains, and high levels of consumer spending have resulted in record-high inflation that has not been seen in decades in both Canada and the United States. In response, the central banks are aggressively raising interest rates to curb inflation and restore price stability. In this rapidly evolving new reality, investors are searching for instruments that can act as a natural hedge against inflation. Among the possible options, floating rate private debt – with its inflation-adjusted return not available in many other debt instruments, added security, and low correlation – fits particularly well into institutional portfolios with long-term investment horizons that seek to minimize volatility and add diversification. There are some particular features of private debt that make it an attractive investment:

Floating Rates Capture Rising Yields

Private debt is typically structured with floating interest rates based on a benchmark rate (e.g., Prime) plus a credit spread. The rate a borrower pays resets with changes in the benchmark rate which often moves lockstep with rate changes made by central banks – as interest rates rise, so does income for lenders. In this regard, floating rate private debt limits interest rate risk that is embedded in traditional fixed-income instruments.

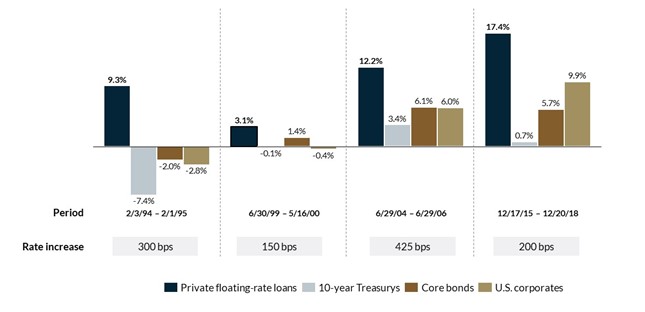

As seen from the figure below, private floating-rate loans have performed exceptionally well in the four most recent cycles of increasing interest rates and provide an attractive instrument to capture yield in institutional portfolios. This performance has historically held true during periods of flat interest rates as well: as estimated by Credit Suisse, the median annual return of floating-rate loans has been higher than that of the U.S. aggregate bond market and U.S. Treasuries by about one and two percentage points, respectively1.

Figure 1. Performance of floating-rate private loans during Fed hiking cycles2

Source: New York Life Investments

Know what’s backing your investment – Protection from Collateral and Added Security

Collateral is an important feature of many private debt investments. In real estate lending specifically, the investment is collateralized, often in a senior position, offering investors security not found elsewhere in the market. Being in a senior position means that in the event of default such loans hold priority claim to the underlying assets and can monetize such assets to recover capital. Historically, floating-rate private loans, including those backed by real estate have returned more than 99% of principal3, and given the income stream generated by such loans, negative returns are rare4. The ability to realize this underlying real estate security provides downside protection for lenders, and ultimately the investors in these products. In times of high inflation, real estate-backed instruments can often provide a natural hedge. For example, a mortgage secured by a multi-family rental project will hold its value as the increase in rental income, which is also driven up by inflation, often offsets the increase in cap rates that traditionally have some correlation to interest rates, but do not move in tandem. In contrast, private debt backed by loans to corporations for working capital purposes may provide limited downside protection in times of stress.

Furthermore, transactions in the private debt space are negotiated directly between the lender and the borrower. This can often lead to superior loan terms and enhanced security – such as covenants and guarantees – resulting in higher risk-adjusted returns for investors that are not typically available in the public markets.

Higher Yield and Low Duration

As compensation for the relative illiquidity of private capital, private debt can typically command higher interest rates compared to investment-grade asset classes making it an ideal fit for investors with longer-term investment horizons. The yield on floating-rate private loans averaged 7.2% over the last 15 years, which is one of the highest returns among debt instruments by a wide margin, slightly below that of U.S. high-yield corporate bonds at about 7.4% over the same period5. For a comparable yield, private debt can offer better downside protection and lower price volatility.

Figure 2. Comparing 15-year average yields by selected debt instrument classes6, as of 3/31/2022

Source: Trez Capital, adapted from Nuveen

Private debt backed by floating rate loans also tends to be shorter term (two to three years), which limits spread duration risk and price volatility. As loans are repaid and capital is reinvested, new loans can be extended at the prevailing market spreads that correspond to the current credit environment. Conversely, traditional longer-term bonds that pay fixed interest rates have much higher duration risk and therefore the value can swing wildly with changes in interest rates.

As a result of both high yields and low duration, floating-rate private loans provide one of the best yield-to-duration combinations: they offer higher returns compared to investment-grade asset classes and comparable returns to high-yield bonds (and typically better security) with lower duration compared to both.

Figure 3. Yield vs Duration for key selected debt instrument classes7

Source: Trez Capital, adapted from New York Life Investments, Nuveen, Eaton Vance, and Neuberger Berman

Low Correlation with Other Asset Classes

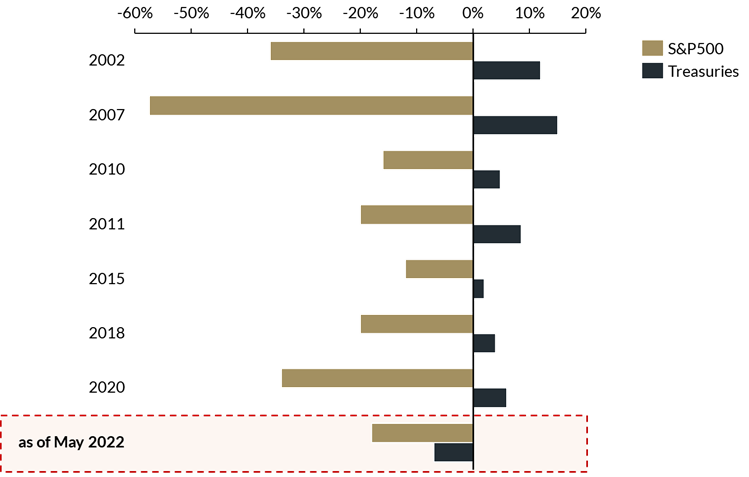

Private debt also exhibits a low correlation with traditional asset classes, such as stocks and bonds, providing portfolio diversification benefits and reduced volatility. What’s more, the current economic cycle may prove to be different when compared to the previous cycles. The traditional relationship – where stocks and bonds values exhibited negative correlation – is “broken” with the reintroduction of inflation: as of March 31, 2022, the rolling 24-month correlation between stocks and bonds has reached almost +0.508, indicating that investors need to consider adding different types of instruments – such as private debt – to their portfolios to achieve desired diversification.

Figure 4. Performance between stocks and bonds during recent ‘bear’ markets8, as of May 26, 2022

Source: KKR based on Bloomberg data

In Summary

Floating-rate private debt backed by real estate is an attractive investment in times of rising inflation and market instability. Given the wide range of credit risk exposure among the investment options in the private debt space compared to investment-grade public debt, it is important for investors to select an experienced manager with a proven track record of consistent returns with rigorous and disciplined institutional-grade due diligence processes. As we enter this new economic cycle of elevated inflation and rising interest rates, manager selection becomes increasingly more important to ensure both capital preservation and the generation of inflation-adjusted returns.

Trez Capital is one of the largest non-bank commercial real estate lenders in Canada and the U.S. with more than 25 years of investment experience. Please reach out to sales@trezcapital.com to find out how our products can help optimize your portfolio returns.

Information presented in this material is information purposes only and does not constitute an offer to buy or sell in any jurisdiction. This information must not be relied upon in making any investment decision. Trez Capital cannot be held responsible for any type of loss incurred by applying any of the information presented. Past performance is not indicative of future performance and cannot be solely relied upon. Trez Capital does not assume responsibility to update any of the information. Trez Capital cannot guarantee the completeness and accuracy of third party information it may use. This material cannot be distributed, altered or communicated without the prior written consent of Trez Capital.

1 Credit Suisse and Bloomberg Indices. “Falling” periods are defined by a decrease of more than 50 bps in Fed Funds rate over rolling 12-month periods from 01/31/93 through 12/31/21. U.S. aggregate bond market is represented by the Bloomberg U.S. Aggregate Bond Index. Credit Suisse Leveraged Loan Index is used to track the performance of floating-rate loans.

2 New York Life Investments. Based on FactSet Research Systems and Morningstar data, 2021. 10-year Treasuries are represented by the ICE BofA Current U.S. Treasury 10-year Index. Core bonds are represented by the Bloomberg Barclays U.S. Aggregate Bond Index. Corporates are represented by the ICE BofA U.S. Corporate Index. Floating rate loans are represented by the Credit Suisse Leveraged Loan Index.

3 Eaton Vance Topic Paper, “The timeless case for floating-rate loans as a strategic allocation”, July 2016.

4 Returns have been positive in 86% of quarters between 1992 and 2016. Source: Eaton Vance Topic Paper, “The timeless case for floating-rate loans as a strategic allocation”, July 2016.

5 As another comparison point, high yield BB-rated corporate bonds, as represented by ICE BofA BB US Corporate Index Effective Yield, returned 6.73% on average over the 25-year period between 1997 and 2021. Source: St. Louis FED.

6 Nuveen, “Five considerations for allocating to private credit”, July 2022. Investment grade corporates are represented by Bloomberg U.S. Corporate Investment Grade Index. High yield corporates – Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index. Preferred securities – ICE BofA U.S. All Capital Securities Index.

* Floating-rate loans are represented by S&P/LTSA Leveraged Loan Index.

7 New York Life Investments, “How a strategic allocation to floating rate loans can build portfolio resiliency”, January 2022. Based on FactSet, S&P Global Market Intelligence data, as of 11/30/21. Nuveen, “Five considerations for allocating to private credit”, July 2022. Eaton Vance Topic Paper, “The timeless case for floating-rate loans as a strategic allocation”, July 2016. Neuberger Berman, “The Case for Floating Rate Loans”, February 2017.

* Floating rate loans are represented by the S&P/LSTA Leveraged Loan Index, data as of as of 11/30/21.

8 KKR, “Walk, Don’t Run: Mid-Year Update 2022”, Volume 12.4, June 2022, Exhibit 4