Investing in Today to Build a Better Tomorrow

Watch our video

-

Over $5.4B Trez Corporate Group assets under management

-

Originated 1800+ loans

-

Over $22.5B in loans funded since inception

Delivering Results for Investors

As a leading investment manager specializing in North American commercial real estate, we uncover the best debt and equity opportunities for our investors.

-

6.5% Return since inception

Learn more -

7.5% Return since inception

Learn more -

8.9% Return since inception

Learn more -

8.9% Return since inception

Learn more

-

0.5% Return since inception

Learn more

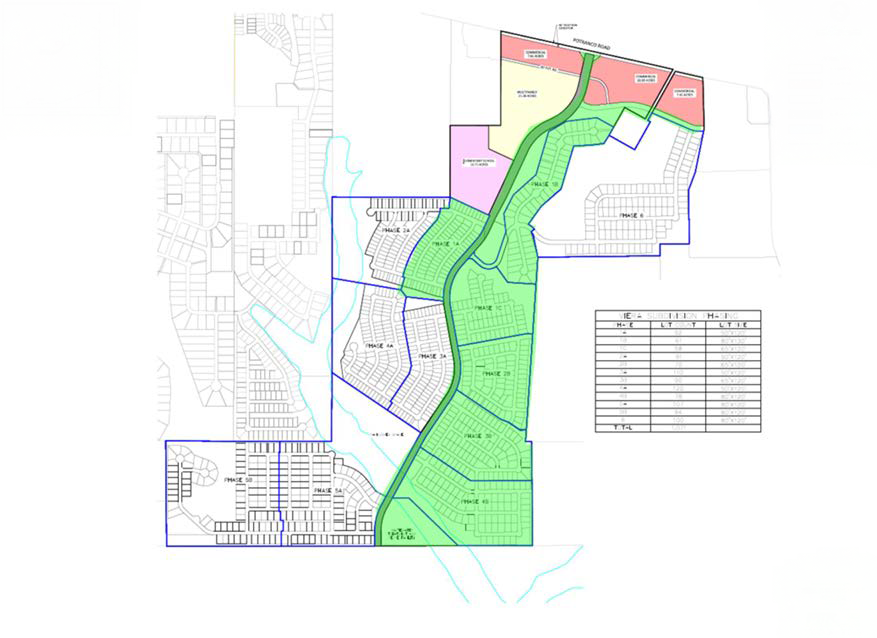

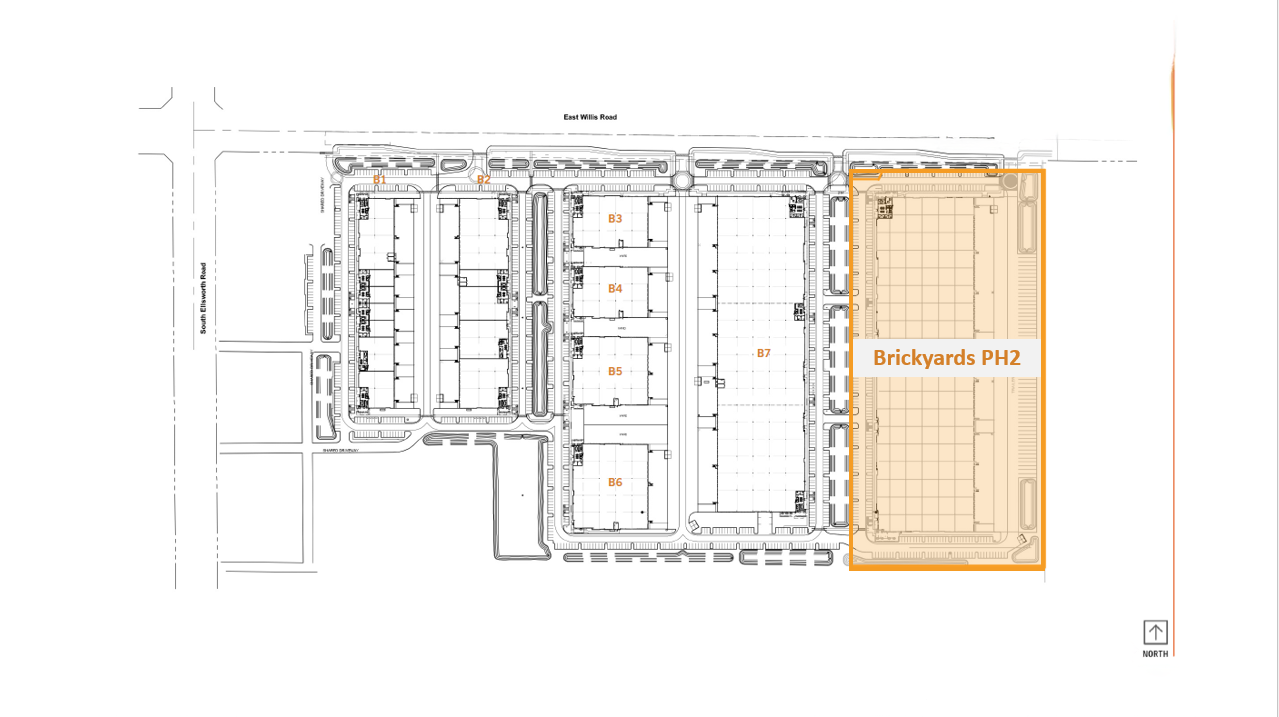

Every Project Starts with a Blueprint

Since 1997, Trez Capital has strategically developed its footprint across key North American commercial real estate markets, replicating its trademark approach to financing with discipline, speed, innovation and integrity.

See all financings & investmentsNews Room

See all newsTrez Capital eyes new US opportunistic fund

Trez Capital U.S. Opportunity Fund IX is expected to launch mid-2026 with a $100m target

The new baseline: The forces shaping CRE in 2026

If 2024 marked the beginning of repricing and 2025 represented the search for stability, 2026 is shaping up to be a year of clearer footing for the commercial real estate investment space.

Contact Us

With team members spread across multiple offices in Canada and the United States, our team prides itself on deep real estate industry expertise and boots-on-the-ground perspective.

View office locations